The Art Market 2021 Report is out. This Art Basel and UBS survey has been prepared by Dr. Clare McAndrew, Founder of Arts Economics. The Pothi team brings you excerpts and overviews of this incisive report. This is part 1 of a six-part series.

As you would expect, the coronavirus pandemic has had a significant impact on the global market. While there are many concerns, it has also shed light on how businesses adapt to adverse situations. This effort at adaptability has been largely web-driven.

The finding of this year’s report is the tremendous ascent of online sales, which doubled in value from 2019 to 2020, accounting for one quarter of total sales. This precipitous rise was the dual product of both tireless digital innovation and sheer necessity. While the permanence of these changes remains to be seen, there is no disputing the roiling impact that the pandemic has had upon the trade.

The art market has seen more development and engagement online in 2020 than ever before. The ability to communicate and continue trading online during the COVID-19 pandemic has been crucial for business survival and most agree that many of the digital changes that occurred in 2020 will be maintained in future.

Despite the contraction of sales overall, the component of online sales of art and antiques reached a record high of $12.4 billion, doubling in value from 2019.

Online sales are defined here as including sales by galleries, dealers, and auction houses made online, either through their own websites, viewing rooms, other platforms or via email, as well as those made through third-party platforms and art fairs.

Global sales of art and antiques reached an estimated $50.1 billion in 2020, down 22% in 2019 and 27% since 2018.

The share accounted for by online sales also expanded from 9% of total sales by value in 2019 to 25% in 2020, the first time the share of e-commerce in the art market has exceeded that of general retail.

The share of online sales in the dealer sector, including art fair online viewing rooms (OVRs), expanded threefold in 2020 to 39% from 13% in 2019. Dealers at all levels showed significant increases in the online component of their sales, with the largest advance by those in the $10 million-plus turnover segment to 47%.

In the fine art auction sector, 22% of the lots sold in 2020 were in online-only sales, double the share in 2019. Works priced over $1 million made up only 6% of total online-only values, versus 58% for offline sales.

However, online sales of art and antiques reached a record high of $12.4 billion, doubling in value on the previous year, and accounting for a record share of 25% of the market’s value.

Although all three of the major art hubs, the US, the UK, and Greater China, experienced a decline in sales, they continued to account for a majority of global sales by value in 2020, at 82%. The US retained its leading position with a share of 42%, with Greater China and the UK on par at 20%.

Sales in the US art market fell by 24% in 2020 to $21.3 billion, but remained 76% above their level in the last recession in 2009.

Greater China’s sales decreased by 12% in 2020 to $10.0 billion, the third year of falling sales values, although a less severe decline than its other major peers.

Sales in the UK declined by 22% to $9.9 billion in 2020, their lowest level in a decade, but still 10% above the previous recession in 2009.

Online art sales were also steadily advancing prior to the COVID-19 pandemic, driven by an expanding global base of buyers, the expansion of technologies, and the increase in e-commerce in general, although with slower growth in its share of the market’s value than initially expected.

Between 2013 and 2019, sales in the online art market doubled, reaching just under $6 billion. Despite this growth, the share of total art sales (at 9%) still lagged behind global retail e-commerce generally (14%). Online sales were also doing relatively little to rival or disrupt the existing offline incumbents, particularly the highest priced sales at auction and in galleries and art fairs. However, as businesses, events, and travel were closed or restricted in 2020, the pivot to online communication, exhibitions, and sales became critical for many businesses’ survival. Traditional galleries and auction companies significantly ramped up digital initiatives, and like other industries built on travel, events, and personal contact, began to engage in a more mainstream way with online technologies that offered a means to maintain liquidity. Besides the shift to e-commerce by auction houses and dealers, art fairs’ online viewing rooms and a variety of third-party platforms also expanded the range of digital options for sales available within the art market.

The growth of online sales by dealers accelerated rapidly in 2020. According to the global survey of dealers conducted at the end of 2020, the share of online sales expanded to three times its size, from 12% in 2019 to 30% in 2020, or 39% including art fair OVRs.

Dealers at all levels showed significant increases in the online component of their sales, but it was those businesses with the largest turnovers that also showed by far the highest rise. In the absence of fairs and other events that previously generated a major portion of their sales, dealers in the $10 million-plus segment more than tripled their share of online sales to 47% (if art fair OVRs are included), an increase of 38% year-on-year.

Dealers with turnovers less than $500,000 saw more moderate increases of around 10%. Overall, the majority of dealers (63%) reported an increase in their share of online sales.

Even in 2020, there were still some galleries that did not make any online sales, although this was a minority of respondents (24%) compared to 41% of the sample in 2019. Of those galleries who did not engage in online selling in 2019, 71% reported that they began making sales online in 2020, and for these businesses, their share of online sales went from nil to 41%, showing the significant transformations some businesses have undergone.

To help galleries advance their visibility and e-commerce online, specialised companies such as Artlogic have assisted in developing art-based websites, viewing rooms, and other online tools. To assess the effects of the pandemic in driving activity and strategies online, it is also useful to examine the experience of these companies in 2020.

There was a significant increase in the number of galleries wanting to develop new websites, with their total number of website clients growing by 75% in the period. On websites developed by Artlogic, activity levels also increased, with the share of galleries making online sales growing 62%, and both the volume and value of those sales also expanding. Clients also engaged much more with galleries online, with the number of email enquiries per site increasing by 66%.

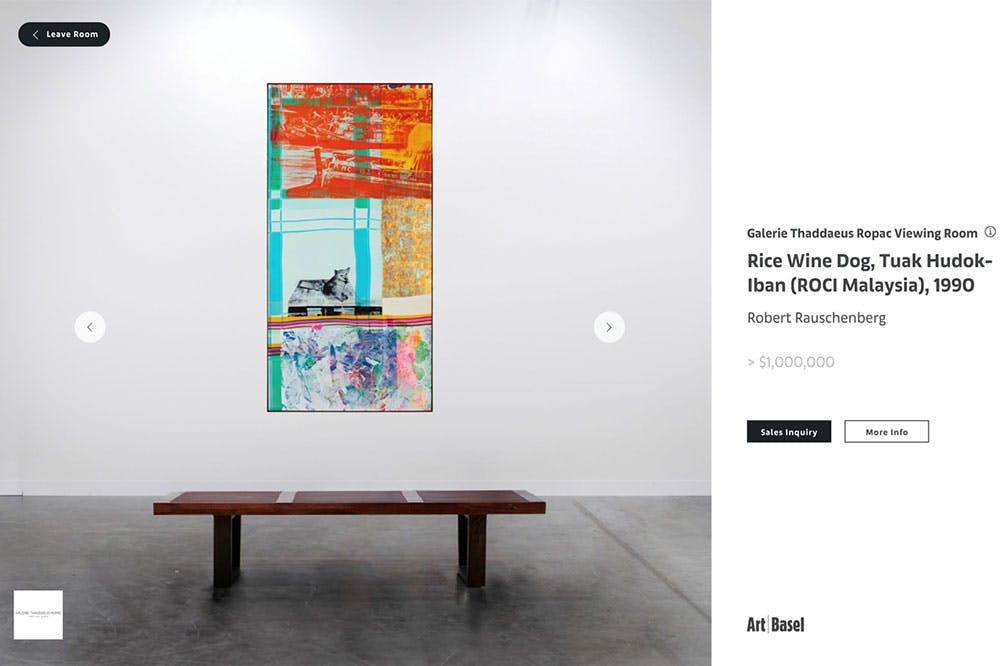

An Art Basel online viewing room (OVR)

An Art Basel online viewing room (OVR)

However, one of the most significant growth trajectories witnessed by Artlogic was the number of clients using online viewing rooms (OVRs), with growth of over 3,000% in this nine-month period. In March, one in 40 of their website clients used OVRs, whereas by December 2020, this had increased to one in three. The development of OVRs in 2020 is discussed further in Exhibit 3.

There were some indications from the survey that the price ceiling for works of art selling online was rising over time. The share of those having not exceeded a price of $50,000 online was 65% in 2019 and 72% in 2018 versus just 33% in 2020.

Art fairs were also successful at directing traffic to their sites, with the major fairs such as Art Basel and Frieze having between 200,000 and 300,000 visitors per month.

Just over one third of HNW collectors had used Instagram to purchase art in 2020. Ninety percent of high net worth (HNW) collectors visited an art fair or gallery OVR in 2020, and 72% felt it was important or essential to have a price posted when browsing works of art for sale online.

When asked about the future of online sales, the verdict was almost unanimous: 94% of auction houses surveyed expected online sales to increase over the next five years.